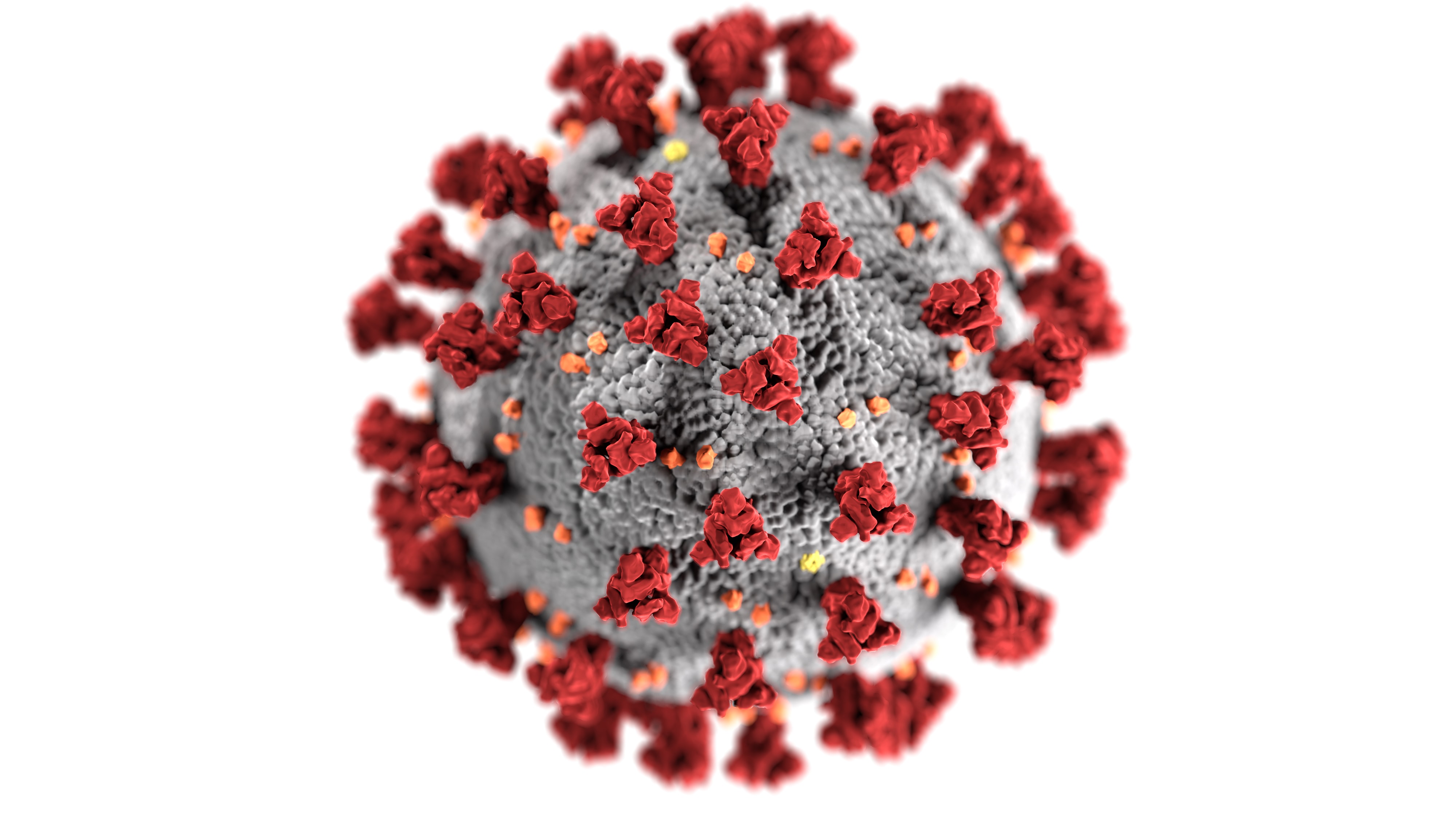

The need for new forms of payments is more pressing than ever before. Even before COVID-19 hit, how we buy and pay for things was shifting.

Fintech has played a huge role in the changing sphere of payments. Growing at an annual rate of 24.8 percent, fintech solutions offer faster, safer, and cheaper payment options. Miami-based fintech, Coro Global Inc. (Coro) is one of the most revolutionary new players in the market, democratizing gold for everyday people to use in everyday transactions.

Gold has been a reliable investment for centuries, retaining its value at a steady rate. On the other hand, paper currencies lose their value the more bills are printed, and cryptocurrencies are highly unpredictable.

Gold has been a reliable investment for centuries, retaining its value at a steady rate. On the other hand, paper currencies lose their value the more bills are printed, and cryptocurrencies are highly unpredictable.

Additionally, gold can withstand crises in a manner that other traditional assets cannot. The value of gold isn’t pegged to how profitable a company is, so stock market dips don’t have the same negative impact.

That’s why Coro is reimagining gold as a fiat currency to be used to pay bills, buy groceries, and even gift to others – without the threat of external factors changing its value.

Users simply download the Coro app, confirm their identity, connect to a bank account, and exchange US dollars for gold. Payments can also be sent and received in USD or gold. All transactions are backed by distributed ledger technology – which is securer than blockchain.

Coro supports 500,000 transactions per second (more than blockchain and credit cards) and has no transactions limits. Users can request their physical gold to be removed from vaults and sent to them at any time.

The app is due to launch in Q2 but can be signed-up for in advance via the waiting list.

Coro Global just announced that its subsidiary Coro Corp was granted a Money Services Business (MSB) license by the State of Florida, Office of Financial Regulation. The license means the company can offer its state-of-the-art global payments system via its app, and users can share currency and gold within Florida state, as well as other MSN-licensed jurisdictions.

Lorenzo Delzoppo, Chief Compliance Officer at Coro, notes that “even before developing Coro’s financial technology, we developed the strongest possible compliance program and regulatory framework to ensure compliant and secure operations on a continuous basis.”

Lorenzo Delzoppo, Chief Compliance Officer at Coro, notes that “even before developing Coro’s financial technology, we developed the strongest possible compliance program and regulatory framework to ensure compliant and secure operations on a continuous basis.”

To get the license, Coro had to adopt a strict compliance program, develop an advanced anti-money laundering system, and conduct an in-depth audit. Because of the high volume of international payments in Florida, the MSB license requirements are especially demanding.

The Florida MSB license is a step toward a fairer, more sustainable financial system, as Coro makes gold accessible to everyone. The practical platform empowers users to make smart choices about their personal finances, and is also connecting unbanked regions around the world.

For example, only 51 percent of everyday people in Latin America have bank accounts at a formal institution. However, with the Coro app, the large Latin American population in Florida can send and receive gold between payees and investors in South America.

Already, the MSB license is already a massive step in Coro’s mission to help people establish financial resilience.

Show Comments